Highlights

- Individual account plan

- Contributions are not fixed, but are discretionary up to a maximum deductible contribution of 25% of covered payroll, but not more than $70,000 in 2025 per individual.

- Contributions are not contingent upon the employer having current or accumulated profits.

- The plan must specify the formula to be used to allocate any contributions among the participants.

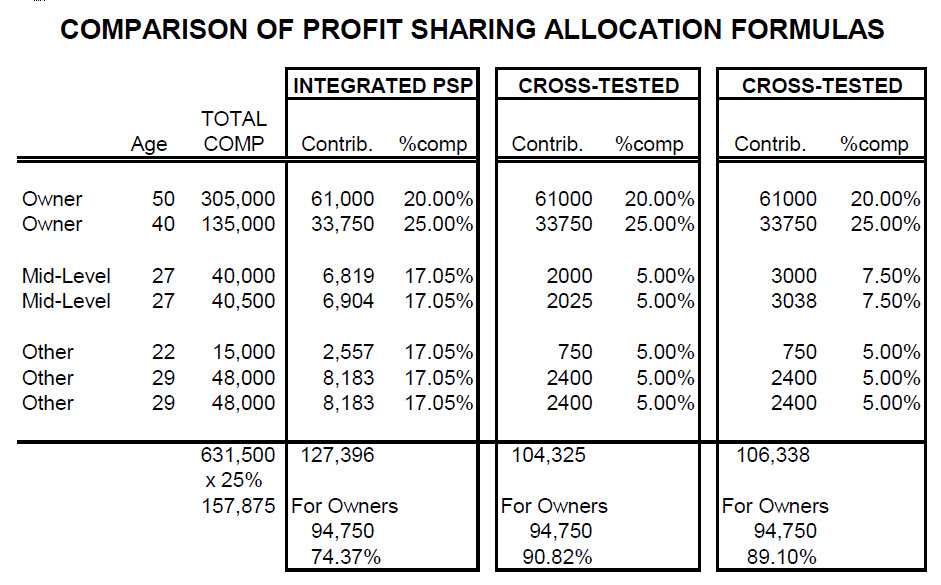

- Various allocation formulas can be used including age-weighted and cross-tested.

- Forfeitures can be used to reduce employer contributions or be reallocated to participants.

Allocation formulas

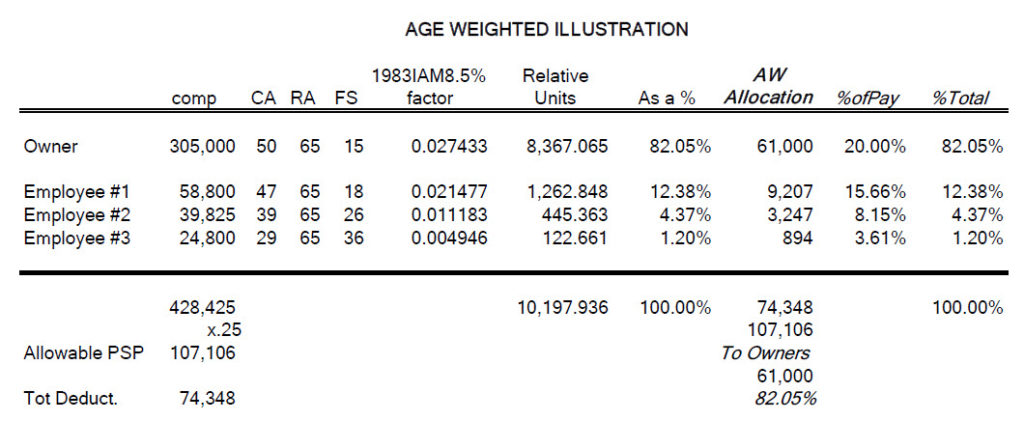

Age Weighted

Cross Tested